Top Wellness Insurance Coverage Program to Secure Your Wellness

When it comes to prioritizing your well-being, choosing the ideal health and wellness insurance plan is an essential decision. Comprehending the subtleties of leading health insurance strategies, including protection specifics, costs, and added rewards like wellness programs, is important for making an informed choice that safeguards both your health and wellness and finances.

Key Functions of Top Health Insurance Policy Plans

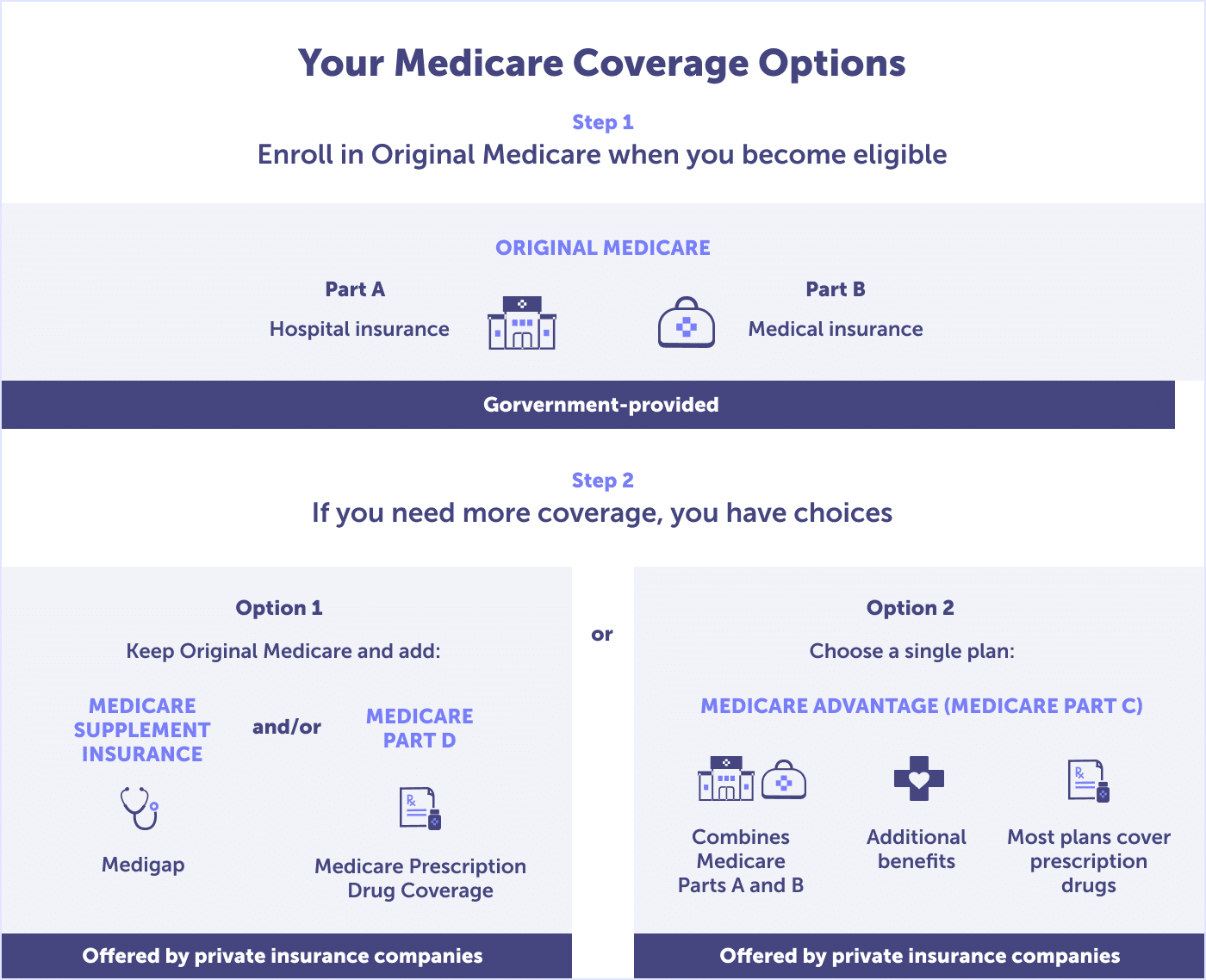

When reviewing top health and wellness insurance plans, a crucial facet to think about is their comprehensive coverage options. A robust medical insurance plan must give coverage for a variety of medical solutions, including hospital keeps, doctor gos to, prescription drugs, precautionary care, and psychological health and wellness solutions. Comprehensive coverage guarantees that individuals and families have access to the treatment they require without facing substantial financial burdens.

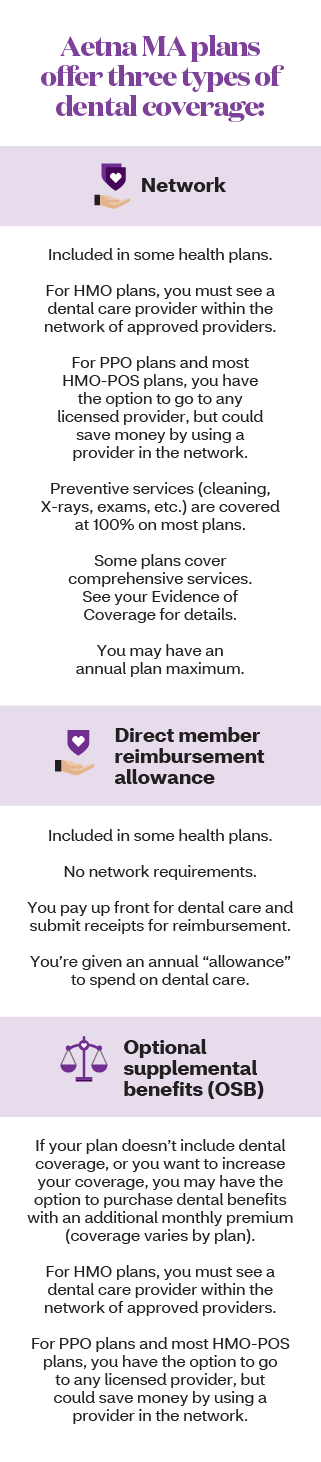

Moreover, top health insurance plans frequently use fringe benefits such as protection for different treatments, maternity treatment, and vision and dental solutions (Health insurance agent near me). These fringe benefits can help people tailor their insurance coverage to fulfill their particular medical care requirements

In addition, top medical insurance strategies usually have a wide network of healthcare service providers, consisting of medical facilities, medical professionals, experts, and drug stores. A robust network makes certain that participants have accessibility to high-quality care and can conveniently discover health care suppliers within their protection location.

Comparison of Premiums and Insurance Coverage

Premiums and coverage are vital aspects to take into consideration when comparing various medical insurance strategies. Premiums are the quantity you spend for your health and wellness insurance policy protection, typically on a month-to-month basis. When contrasting costs throughout different strategies, it is essential to look not just at the price yet also at what the premium consists of in terms of coverage. Reduced costs may mean greater out-of-pocket expenses when you require clinical care, so locating a balance between premium costs and coverage is crucial.

Protection refers to the services and benefits given by the health insurance plan. A plan with extensive coverage might have higher costs yet could inevitably save you cash in the long run by covering a greater portion of your health care costs.

Advantages of Including Health Programs

An important aspect of health and wellness insurance policy strategies is the incorporation of health cares, which play a critical role in advertising overall health and preventive care. Health care include a variety of efforts aimed at boosting individuals' wellness and decreasing health risks. By including wellness programs in medical insurance plans, insurance holders access to various sources and tasks that focus on boosting physical, psychological, and psychological wellness.

One considerable advantage of integrating health cares is the emphasis on precautionary treatment. These programs often include routine health screenings, vaccinations, and lifestyle straight from the source mentoring to help people keep healthiness and address potential issues prior to they rise. Additionally, health cares can urge healthy behaviors such as normal exercise, well balanced nutrition, and anxiety administration, ultimately leading to a healthier lifestyle.

Recognizing Plan Restrictions and Exclusions

Insurance holders should recognize the restrictions and exemptions detailed in their health insurance policy plans to fully recognize their coverage. Policy limits refer to the maximum amount the insurance company will certainly spend for covered solutions within a certain period or for a particular problem. It is critical for individuals to be conscious of these restrictions to stay clear of unexpected out-of-pocket costs. Exemptions, on the various other hand, are specific services or conditions that are not covered by the insurance policy strategy. Common exclusions may include cosmetic procedures, experimental treatments, and pre-existing problems. Recognizing these exemptions is crucial as insurance holders might need to seek different protection or repayment options for any type of services that are not covered. By being educated regarding plan restrictions and exclusions, people can make even more informed decisions concerning their healthcare and monetary planning. It is a good idea for insurance policy holders to review their policy papers very carefully and seek advice from their insurance provider to make clear any type of uncertainties regarding protection limitations and exemptions.

Tips for Choosing the Right Strategy

When picking a health and wellness insurance coverage plan, it is crucial to carefully review your health care needs and economic factors to consider. It's also essential to review the network of healthcare service providers included in the strategy to guarantee your from this source recommended doctors and healthcare facilities are covered.

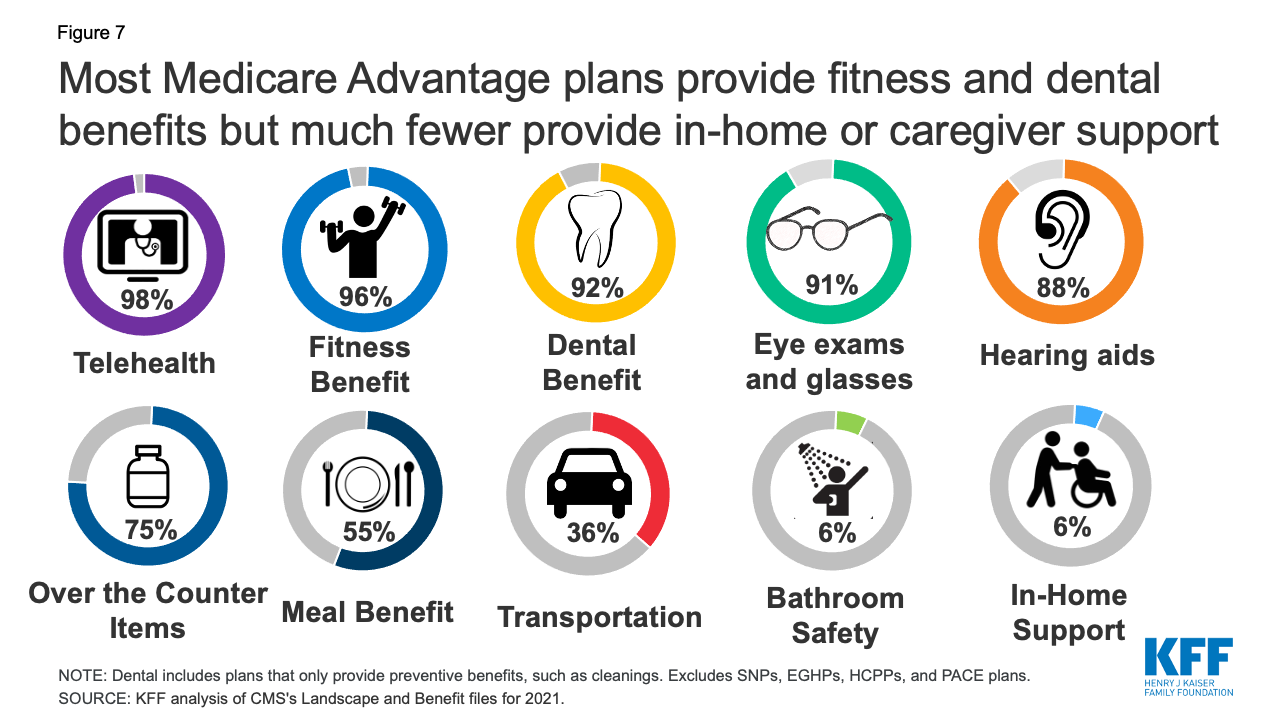

In addition, consider any kind of extra benefits used by the plan, such my website as health cares, telemedicine services, or protection for different therapies. By thoroughly assessing your healthcare demands and monetary scenario, you can pick a medical insurance strategy that properly safeguards your health.

Final Thought

Finally, selecting a top health and wellness insurance coverage plan is vital for safeguarding one's health. By comparing premiums and insurance coverage, including wellness programs, recognizing policy restrictions and exemptions, and choosing the appropriate strategy, individuals can guarantee they have the essential defense in location. It is very important to thoroughly consider all facets of a health and wellness insurance coverage plan to make an informed decision that satisfies their specific demands and provides assurance.